Present cash value calculator

Present value of a growing annuity. Discounted Cash Flow DCF Calculator.

Present Value Of Uneven Cash Flows All You Need To Know Cash Flow Financial Life Hacks Financial Management

Press SHIFT then C ALL and store the number of periods per year in PYR.

. Firstly figure out the future cash flow which is denoted by CF. The present value calculator uses the following to find the present value PV of a future sum plus interest minus cash flow payments. Once we sum our cash flows.

The difference between the two is that while PV represents the present value of a sum of money or cash flow NPV represents the net of all cash inflows and all cash outflows similar to how the. These steps describe how to calculate NPV. In the long run a positive NPV value indicates good potential return over investment while the negative NPV value means that the investment is likely to loose money.

We can combine equations 1 and 2 to have a present value equation that includes both a future value lump sum. Next decide the discounting rate. The cash flow may be an investment payment or savings cash flow or it may be an income cash flow.

Present Value Formula for Combined Future Value Sum and Cash Flow Annuity. NPV is used in capital. Using the Online Calculator to Calculate Present Value of Cash Flows.

PV Present Value C Cash Flow at a period n number of period r rate of return. For example if you receive 5000 now in one lump sum it has more value than receiving 1000 a year for the next 5 years. Similar to the formula for an annuity the present value of a growing annuity PVGA uses the same variables with the addition of g as the rate of growth of the annuity A is the annuity payment in the first period.

We start with the formula for PV of a future value FV single lump sum at time n and interest rate i. The present value PV of a series of cash flows is the present value at time 0 of the sum of the present values of all cash flows CF. These cash flows can be fixed or changing.

It is a representative amount which states that instead of waiting for the Future Cash Flows if you want the amount today then how much would you receive. Present Value of Future Cash Flow is nothing but the intrinsic value of the Cash Flow due to be received in the future. Present Value 96154 92456 88900 85480.

First enter the payments future value and its discount rate. Present Value of Annuity Due PVAD Calculator. Present value helps us recognize when a quoted future cash flow might not be as great as its made out to be.

Present Value of Annuity PVA Calculator. Net Present Value NPV is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. Initial Investment Discount Rate Cash Flow.

Net Present Value - NPV. This calculator can help you figure out the present day value of a sum of money that will be received at a future date. This page contains a bond pricing calculator which tells you what a bond should trade at based upon the par value of the bond and current yields available in the market sometimes known as a yield to price calculator.

The idea behind present value is that money you receive today is worth more than the same amount of money if you were to receive it in the future. The present value of annuity can be defined as the current value of a series of future cash flows given a specific discount rate or rate of return. Once we calculate the present value of each cash flow we can simply sum them since each cash flow is time-adjusted to the present day.

And our cash flow earned in Year 3 thrice. Thus this present value of an annuity calculator calculates todays value of a future cash flow. DCF analyses use future free cash flow projections and discounts them using a.

1 is the minimum. The NPV Calculator provides NPV or Net. It sums the present value of the bonds future cash flows to provide price.

In this case each cash flow grows by a factor of 1g. Expense Ratio Impact Calculator. See Present Value Cash Flows Calculator for related formulas and calculations.

Present value is what cash flow received in the future is worth today at a rate of interest called the discount rate. The formula for the present value can be derived by using the following steps. Present Value - PV.

This is a calculation that is rarely. Enterprise Value EV Calculator. Present Value of Annuity Continuous Compounding PVACC Calculator.

Interest Rate discount rate per period This is your expected rate of return on the cash flows for the length of one period. Go for an automatic tool to calculate PV of cash flows if you want to be sure that your calculations are quick and precise. Simple future value calculations regarding a single lump sum are easier to calculate principal 1 rate periods while future value calculations of annuities varying cash flows or.

How to Figure Out the Present Value of a Future Sum of Money. This present value calculator can be used to calculate the present value of a certain amount of money in the future or periodical annuity payments. The present value PV is what the cash flow is worth today.

Discounted cash flow DCF is a valuation method used to estimate the attractiveness of an investment opportunity. Future Value FV. PV formula examples for a single lump sum and a series of regular payments.

A calculator will give you a detailed report about the present value of your future cash flows. It returns a clean price and dirty price market price. You must use the mathematical formula.

The net present value NPV function is used to discount all cash flows using an annual nominal interest rate that is supplied. PV C 1rn. Free Cash Flow FCF Calculator.

The present value calculator calculates the present-day value PV of an amount that you receive in the future. Compounding If there is compounding this is number of times compounding will occur during a period. The following table provides each years cash flow and the present value of each cash flow.

The expected return of 10 is used as the discount rate. Present value of an annuity is finance jargon meaning present value with a cash flow. Present Value Therefore the present-day value of Johns lottery winning is.

It can be simply represented as the difference between the present value of cash inflows and the present value of cash outflows. Future cash flows are discounted at the discount. Present Value of Cash Flow Formulas.

You can use the following Present Value Factor Calculator. The company estimates that the first year cash flow will be 200000 the second year cash flow will be 300000 and the third year cash flow to be 200000. Whether its on a business or personal level.

For example a court settlement might entitle the recipient to 2000 per month for 30 years but the receiving party may be uncomfortable getting paid over time and request a. The most common uses for the Present Value of Annuity Calculator include calculating the cash value of a court settlement retirement funding needs or loan payments. Present value PV is the current worth of a future sum of money or stream of cash flows given a specified rate of return.

Net Present Value NPV Calculator. The easiest way to calculate present value is to use one of the many free calculators on the internet or a financial calculator app like the HP12C Financial Calculator available on Google Play and in the Apple App. The tutorial explains what the present value of annuity is and how to create a present value calculator in Excel.

Present Value Calculator Npv Investment Advice Financial Independence Financial Calculators

Calculate Npv In Excel Net Present Value Formula Excel Excel Hacks Formula

Download Npv And Xirr Calculator Excel Template Exceldatapro Excel Templates Financial Analysis Templates

Definition Of Net Present Value Financial Calculators Financial Education Financial Problems

Calculate The Cash Flow Value By Net Present Value Calculator Npv Calculator Is The Calculator By Which You Can Get T Cash Flow Calculator Financial Decisions

Download Npv And Xirr Calculator Excel Template Exceldatapro Excel Templates Templates Cash Flow

Formula For Calculating Net Present Value Npv In Excel Excel Templates Proposal Templates Proposal Writing

Present Value Table Meaning Important How To Use It Managing Your Money How To Raise Money Skills To Learn

Formula For Calculating Net Present Value Npv In Excel Formula Excel Economics A Level

Pin On Personal Finance

Npv Irr Calculator Template Excel Template Calculate Net Etsy In 2022 Excel Templates Excel Tutorials Excel

Profitability Index Formula Calculator Excel Template Regarding Net Present Value Excel Template Excel Templates Meeting Agenda Template Agenda Template

Texas Instruments Ba Ii Plus Tutorial For The Cfa Exam By Mr Arif Irfanullah Youtube Exam Financial Calculator Tutorial

Net Present Value Calculator Template Are You Looking For A Net Present Value Calculator Template In Excel Download This Npv C Templates Calculator Presents

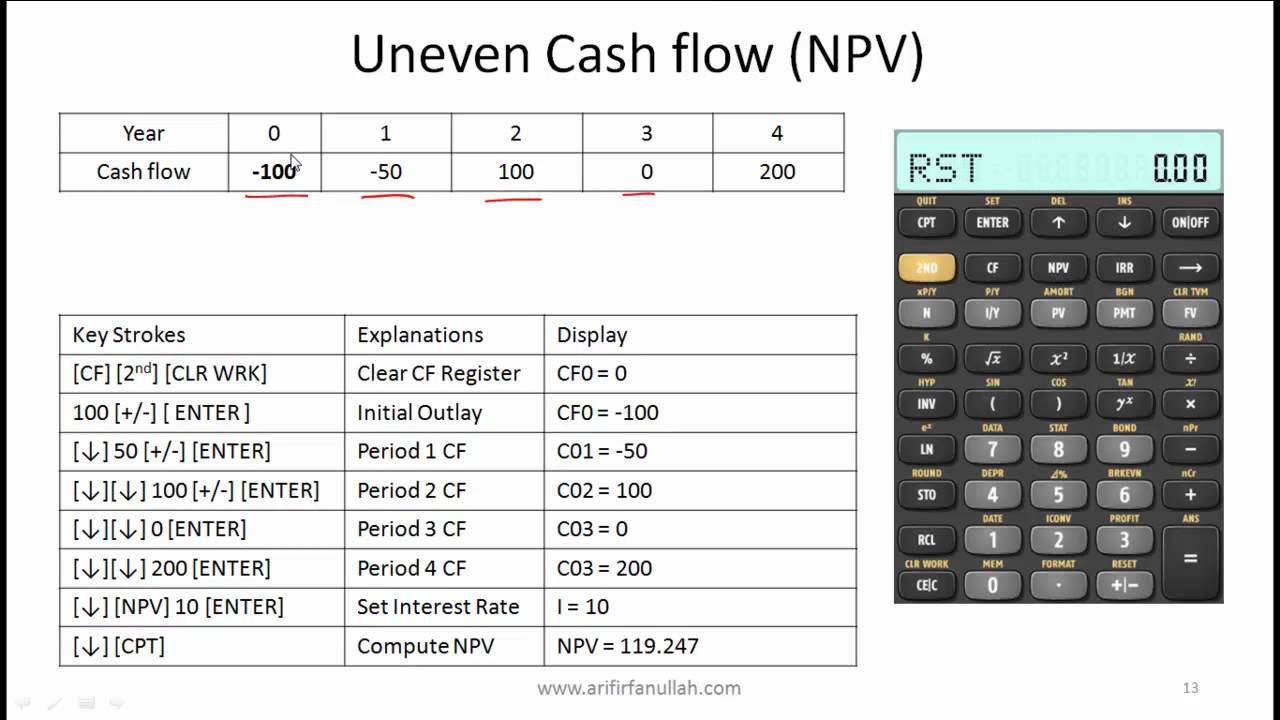

1 Ba Ii Plus Cash Flows Net Present Value Npv And Irr Calculations Youtube Cash Flow Calculator Financial Decisions

James Stith This Shows In Different Terms And Currency To Calculate Accounting Rate Of Return Arr Cash Flow Statement Financial Statement Investing

Npv Irr Calculator Template Excel Template Calculate Net Etsy Excel Templates How To Plan Calculator